Location-based advertising and marketing report

Overview

Location-Based Advertising and Marketing is a comprehensive report analysing the latest developments on the location-targeted advertising market worldwide. This strategic research report provides you with 170 pages of unique business intelligence including 5-year industry forecasts and expert commentary on which to base your business decisions.

Price:

Paper copy: US$1,500

PDF (1-5 user license): US$2,250

PDF (Corporate license): US$4,500

Number of pages: 170

Publishing date: June 2012

The report allows you to:

- Identify tomorrow’s most profitable LBA opportunities in the mobile space.

- Understand the fundamentals of the ad-based mobile media revenue models.

- Recognise the key enablers of growth in the LBA market.

- Comprehend the relative importance of digital channels compared to other advertising media.

- Learn about the experiences of LBA campaigns by top global brands.

- Profit from valuable insights about LBA business models.

Key questions answered by the report:

- In what ways can location technology improve the relevancy of mobile advertising?

- What are the experiences from mobile LBA campaigns so far?

- How should mobile LBA be integrated in the marketing media mix?

- Which categories of companies can leverage mobile locationbased advertising?

- Which are the LBA specialists that stand out of the crowd?

- How are mobile operators such as AT&T, Telefónica and SFR approaching LBA?

- How are traditional mobile advertising players and major digital and telecom players positioning themselves in this market?

- How well suited for LBA are different existing and future mobile media channels?

- Which are the main drivers and barriers affecting the mobile LBA market?

Who should by this report:

Location-Based Advertising and Marketing is the foremost source of information about the status, future trends and technology developments on this market. Whether you are a telecom vendor, mobile operator, advertising agency, investor, consultant or application developer, you will gain valuable insights from our in-depth research.

Table of Content

Executive summary

1 Advertising and the mobile channel

1.1 Advertising and digital media

1.1.1 The marketing and advertising industry

1.1.2 The Internet media channel

1.1.3 The mobile media channel

1.2 Mobile advertising and marketing

1.2.1 The mobile handset as an advertising platform

1.2.2 Advertising on the mobile handset

1.2.3 The mobile advertising ecosystem

1.3 Mobile media channels and formats

1.3.1 Messaging

1.3.2 Mobile web advertisement

1.3.3 Mobile applications

1.4 Mobile marketing industry overview

1.4.1 Factors influencing the potential market value of mobile advertising

1.4.2 Current state and future trends

2 Mobile location technologies and services

2.1 Mobile network location architectures and platforms

2.1.1 Location architecture for GSM/UMTS networks

2.1.2 Location architecture for LTE networks

2.1.3 Control Plane and User Plane location platforms

2.1.4 Probe-based location platforms

2.2 Mobile location technologies and methods

2.2.1 Cell-ID

2.2.2 Enhanced Cell-ID

2.2.3 RF Pattern Matching

2.2.4 E-OTD, OTDOA and U-TDOA

2.2.5 GNSS: GPS, GLONASS, Galileo and Compass

2.2.6 Bluetooth, NFC and Wi-Fi positioning

2.2.7 Hybrid, mixed mode and indoor location technologies

2.2.8 Theoretical limitations of positioning technologies

2.3 Overview of mobile location-based services

2.3.1 Mapping and navigation

2.3.2 Local search and information

2.3.3 Social networking and entertainment

2.3.4 Recreation and fitness

2.3.5 Tracking services

3 Mobile location-based advertising and marketing

3.1 Definitions and variants of LBA

3.1.1 Static versus real-time location-targeting

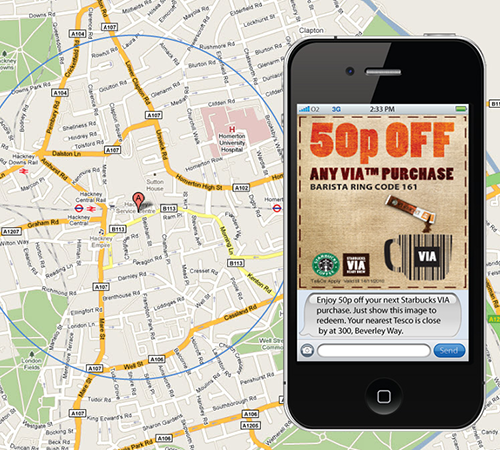

3.1.2 Push and pull LBA

3.1.3 LBA formats

3.2 Market receptiveness

3.2.1 Advertiser adoption

3.2.2 Outcomes of different LBA strategies

3.2.3 Consumer attitudes

3.2.4 Privacy concerns

3.3 Case studies

3.3.1 The North Face drives foot traffic with LBA program delivered by Placecast

3.3.2 Operator Zain Kuwait enters the LBA space with AdZone platform

3.3.3 SPH a pioneer in location-based advertising in Singapore

3.3.4 LBA solution from NAVTEQ delivers impressive results for McDonald’s

3.3.5 VW engage in Wi-Fi-based marketing through JiWire

3.3.6 Boloco taps SCVNGR to encourage repeat visits

3.3.7 Expedia creates award winning location-based mobile website using HTML5

3.3.8 McDonald’s engages customers in billboard games

3.3.9 MINI’s location-based reality game attracts thousands of players

3.3.10 Rovio introduces a location-dimension to the Angry Birds game

3.3.11 QderoPateo and Kommunity Kiosk enable Bluetooth marketing at hotels

3.3.12 Movie theatre chain partners with ChaCha to promote Twilight premiere

4 Market forecasts and trends

4.1 LBA industry analysis

4.1.1 Classification of LBA offerings

4.1.2 LBA specialists

4.1.3 Mobile operators

4.1.4 LBS and navigation providers

4.1.5 Location-aware applications and media

4.1.6 Mobile coupons and deals providers

4.1.7 Mobile search providers

4.1.8 Proximity marketing providers

4.1.9 Traditional mobile advertising players

4.1.10 Major digital and telecom players

4.1.11 Mergers and acquisitions

4.2 LBA landscape trends

4.2.1 Drivers for success

4.2.2 Barriers to adoption

4.2.3 Overcoming the barriers

4.3 Market forecasts

4.3.1 Total, digital and mobile advertising market value forecasts

4.3.2 LBA market value forecast

4.4 Final conclusions

4.4.1 Location filtering improves the effectiveness of mobile marketing campaigns

4.4.2 Greater shares of ad budgets devoted to LBA among marketers

4.4.3 Location is but one of many valuable opt-in variables

4.4.4 High-precision real-time geotargeting is sparsely used

4.4.5 Mobile search and SMS campaigns are important high-volume LBA formats

4.4.6 Location-targeting will eventually become ubiquitous

5 Company profiles and strategies

5.1 LBA specialists

5.1.1 AdMoove

5.1.2 Chalkboard

5.1.3 CityGrid Media

5.1.4 LEMON Mobile

5.1.5 Placecast

5.1.6 xAd

5.1.7 Xtify

5.1.8 YOOSE

5.2 Mobile operators

5.2.1 AT&T Mobility

5.2.2 Orange Group

5.2.3 SFR

5.2.4 Telefónica Group

5.3 LBS and navigation providers

5.3.1 Appello Systems

5.3.2 Intersec

5.3.3 TeleNav

5.3.4 Telmap

5.3.5 TomTom

5.3.6 Waze Mobile

5.4 Location-aware applications and media

5.4.1 Foursquare

5.4.2 Loopt

5.4.3 Shopkick

5.4.4 WHERE

5.5 Mobile coupons and deals providers

5.5.1 COUPIES

5.5.2 GeoAd

5.5.3 Groupon

5.5.4 ThinkNear

5.5.5 Yowza!!

5.6 Mobile search providers

5.6.1 Mobile Commerce

5.6.2 Poynt

5.6.3 Qype

5.6.4 Yell Group

5.7 Proximity marketing providers

5.7.1 BLIP Systems

5.7.2 Proximus Mobility

5.7.3 Qwikker

5.7.4 Scanbuy

5.8 Traditional mobile advertising players

5.8.1 InMobi.

5.8.2 Jumptap

5.8.3 Madvertise

5.8.4 Millennial Media

5.8.5 Nexage

5.8.6 Sofialys

5.9 Major digital and telecom players

5.9.1 Apple

5.9.2 Facebook

5.9.3 Google

5.9.4 Microsoft

5.9.5 Nokia

5.9.6 Yahoo!

Glossary

List of Figures

Figure 1.1: Global advertisement expenditure by media (World 2010)

Figure 1.2: Top 20 advertisers (World 2010)

Figure 1.3: Online advertisement expenditure by region (World 2010)

Figure 1.4: Mobile subscriptions by region (World Q4-2010)

Figure 1.5: Stakeholders in the mobile marketing value chain

Figure 1.6: SMS ads – number of receivers and response rates (EU5 September 2010)

Figure 2.1: Location architecture overview

Figure 2.2: Cellular frequency reuse pattern

Figure 2.3: Cell-ID location methods

Figure 2.4: Performance and limiting factors for key positioning technologies

Figure 2.5: Navigation app and service providers by active users (World Q3-2011)

Figure 3.1: Examples of location accuracies suitable for LBA

Figure 4.1: Categorisation of LBA players

Figure 4.2: Acquisitions in the LBA ecosystem (2009–2012)

Figure 4.3: Total, digital and mobile ad revenues by region (World 2010–2016)

Figure 4.4: LBA revenues and forecasts by region (World 2010–2016)

Figure 5.1: Overview of LBA industry players

Figure 5.2: European operator offerings powered by Appello Systems (October 2011)

Figure 5.3: North American operator offerings powered by TeleNav (September 2011)

Figure 5.4: Waze user interface and example of location marker and expanded ad

Figure 5.5: Loopt user interface, Qs and Groupon Now! deals notifications

Figure 5.6: Groupon map UI on iPhone

Figure 5.7: Screenshots from Qype for iPhone and Android